but it's only paper and wars we're offering.

Ain’t that the American way! Export our garbage and our wars haha.

In a tit-for-tat trade war the surplus nation has always come out on the short end of the deal.

Here’s a thought. Running a surplus isn’t something big businesses like. It’s

bad for business. The input costs are there but the full revenue is not because some product is sitting on a shelf. Businesses are forever trying to get rid of surplus. I don’t know if I feel that they’re getting the “short end”, as if other nations are screwing them over - it’s not like a company is forced to make a surplus. They know the economy ebbs and flows and if they scaled up during a rise, well, they have nobody to blame but themselves when they’re overly scaled during a downturn. The fallacy of infinite growth and how that ties into shareholder value also comes into play here, a prime driver of surplus. More more more isn’t always a sustainable business model, as much as that’s the overriding business strategy of our time.

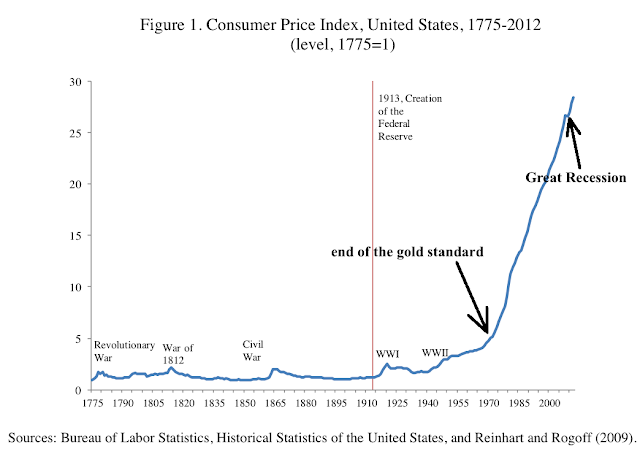

This is why credit is so popular. That’s on both a global scale with respect to trade, and on a personal level so we can keep buying junk, It’s a release valve for surplus so the graph of profit over time can keep going up and shareholder dividends can march along. Do that enough and oops! Now somebody owns all your debt! When you party hard, the party can only go on for so long - and you have nobody to blame but yourself. Borrowed money, borrowed time.

Trump isn't stupid, or at least his economic advisors aren't and he/they seem to have a plan (despite what the useless news is saying, who can only run around like chicken littles). We're at trade deficits with almost every nation except Australia and UK.

The relative intelligence of these maneuvers, I think, is dictated by who they’re serving.

Crashing the Dollar is a real worry but then again are the BRICs ready to fill the void?

That project probably isn’t completely ready yet, but there’s nothing like an emergency or deadline to kick yourself into action. Voids are often filled rapidly. My best school papers were written the night before they were due. Pressure or a deadline is great for productivity. I see this as playing with fire. We tell the world “fvck you, you’re going to do things are way” and leave a huge void by tanking the global economy. What if they call our bluff and manage to fill the void? That’s a huge gamble. And who’s on the hook for it? You and I my friend. To the people making these we’re probably less even than a bargaining chip, we’re nothing, and they’ll weather the storm just fine.

What will? It will accelerate de-dollarization I assume but the U.S. has the leverage. None of this will be painless but the future wasn't bright anyway so what are the options?

Options … I have complaints about the way things have gone for years under any party’s leadership, but if this continues I know for me personally, my life will be significantly worse off. So just reducing this to a simple before versus after it seems like maybe we weren’t out of options. Things weren’t great but my life wasn’t materially bad before.

Anyway, the movers and shakers, particular the Mag 7 techs (which combined are 30% of the Dow valuation) aren't being blindsided by this.

I’m scratching my head about the lack of public outcry from CEOs. There must be a reason most of them haven’t been vocal about this. Are they in on something we don’t know?

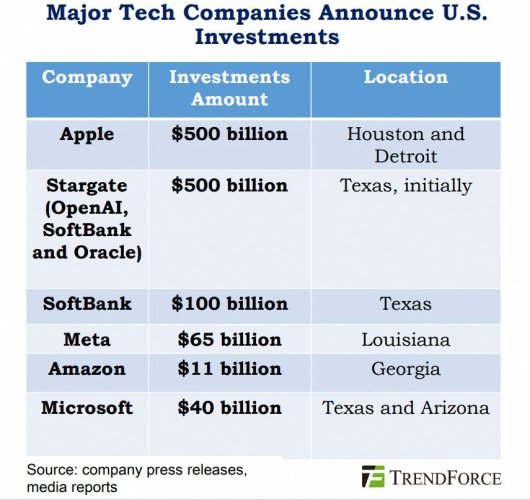

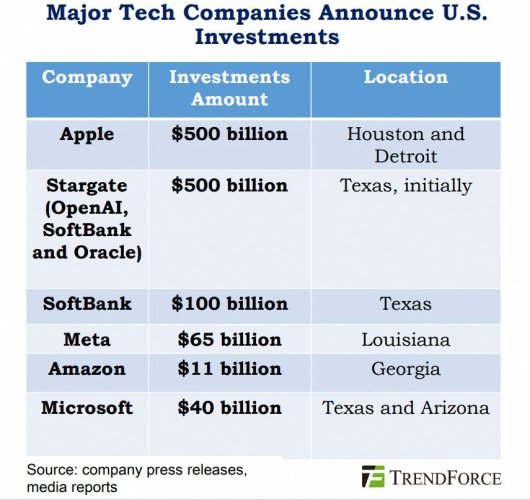

For example, these piece of news in the past few weeks. There's been announced $1 trillion in new domestic investment by the likes of Apple and Nvidia.

Apple today announced plans to spend and invest more than $500 billion in the U.S. over the next four years.

www.apple.com

Nvidia CEO Jensen Huang, the AI company's founder, reportedly said that "several hundred billion" dollars will be spent in the next four years on U.S. production.

www.foxbusiness.com

After Donald Trump took office, in response to his call for companies to invest in the U.S., many major tech companies made investment commitments. Ac...

www.trendforce.com

Announcements =/= investment. I’m a pessimist so I’ll believe it when I see it. Don’t get me wrong, those things

are good news. But there have been announcements like that in the past that never materialized.

globalization predatory class

Who dat?

Somebody has, that’s for sure!

It's not a crime to look out for your own interests and country.

Country equals who exactly?

Who dat?

The whole ends justify the means. Yeah, that usually ends up biting you in end. I dunno.

Some pretty bad dudes have said that kind of stuff before. I’m mostly thinking of genocidal dictators here. Again, we’re less than pawns in their game. Not just economically, but in broader terms, perhaps theoretically. There are people in power all over the world who absolutely do not bat an eye to the suffering of regular Joe Schmoes. Their “end” might serve only them, and if their “means” hurts you and I … they aren’t sweating it. It’s happened over and over in history.

Good stuff Dave. Enjoying this.

www.yahoo.com