Cruisertrash

Rising Sun Member

This is too funny not to comment on!

*Made in China (You will even pay the tariff on 'Murica merch haha!)

Liberation Day Flags & Shirts*I hope everyone is ready for our new national holiday on April 2nd. Better hurry and get to Walmart so you can get your new liberation day flags and shirts.

*Made in China (You will even pay the tariff on 'Murica merch haha!)

I have a wild guess that's not going to wind up in my pocket!At least we're getting a 6 trillion dollar tax break over the next 10 years.

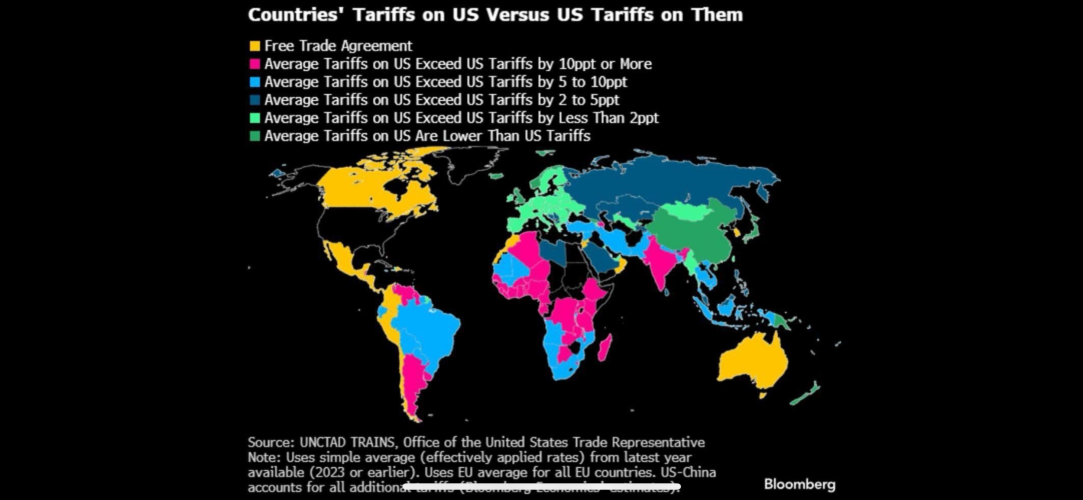

Lol. As I stated above, and what I'm hearing from other friends that run small businesses - pass on the cost of tariffs to the consumer or close up shop. Learned this in Econ 101 my second semester in college.Navarro, Trump’s senior counselor for trade and manufacturing, insists it’s not a tax increase but a tax cut — echoing the Trump administration’s repeated belief that tariffs will be paid not by American consumers but by businesses in other countries or the countries themselves.

Out of our pockets, by our spending ... if they can sell enough cars and crap at the increased rates. They really figured out another avenue to funnel money upward. Amazing.The non-auto tariffs alone “are going to raise about $600 billion (a year), about $6 trillion over a 10-year period,” Navarro said. Cars, he said, would add another $100 billion annually.