Do we have a final verdict on this yet?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BOI report? WTF? (Small biz owners)

- Thread starter Cruisertrash

- Start date

HDavis

Hard Core 4+

- Joined

- Feb 13, 2019

- Messages

- 1,381

I don't know what your business is, but my wife literally only sells blankets, and we had to file.Do we have a final verdict on this yet?

Let's use this opportunity to share a links to our small business in hopes that we can support each others endeavors.

Everyone needs blankets, these are designed in Colorado and made in upstate New York.

Otto Hill

A home goods design collective specializing, offering unique and custom designs to enhance living spaces. Focused on providing products that are designed and crafted in the USA.

We are in publishing and file as an S-corp. guess I’ll make time to do this in short order.I don't know what your business is, but my wife literally only sells blankets, and we had to file.

Let's use this opportunity to share a links to our small business in hopes that we can support each others endeavors.

Everyone needs blankets, these are designed in Colorado and made in upstate New York.

Otto Hill

A home goods design collective specializing, offering unique and custom designs to enhance living spaces. Focused on providing products that are designed and crafted in the USA.www.ottohill.com

KC Masterpiece

Hard Core 4+

- Joined

- May 4, 2019

- Messages

- 1,923

The filing requirement has been paused, reinstated, and paused again in the last week....

I expect it will ultimately be found unconstitutional and was just a roundabout way to add another "tax" to businesses. People will forget to file, get an intimidating notice that they owe $20,000 in fines, and then an offer to settle for a few thousand.

I expect it will ultimately be found unconstitutional and was just a roundabout way to add another "tax" to businesses. People will forget to file, get an intimidating notice that they owe $20,000 in fines, and then an offer to settle for a few thousand.

Last edited:

man, I was hoping to blow this off... but it looks like it's legit again. Here's the most recent info I received from my CPA, received on thursday:

On Monday, December 23, 2024, a three-judge panel of the United States Circuit Court of Appeals for the Fifth Circuit (the “Fifth Circuit Court of Appeals”) lifted the nationwide injunction issued on December 3, 2024, by a federal judge in Texas who concluded that the Corporate Transparency Act was likely unconstitutional. This latest ruling (12/23/2024) causes the Corporate Transparency Act (“CTA”), which went into effect on January 1, 2024, to be once again fully enforceable.

Following the Fifth Circuit Court of Appeals ruling, the Financial Crimes Enforcement Network (“FinCEN”) announced extended deadlines on December 23, 2024, for fulfilling initial reporting obligations under the CTA (see below).

As reported by the National Law Review, “This situation is rapidly evolving. In the coming days, the challengers in this case could seek further review from the Fifth Circuit or seek relief from the United States Supreme Court. Additionally, several other federal courts are actively considering challenges against the CTA.”

THE EFFECTS OF THE RULING:

Corporations, limited liability companies, and limited partnerships created or registered to do business in the United States (each a “Reporting Company”) are required to file a Beneficial Ownership Information Report (“BOIR”) with FinCEN unless the Reporting Company is exempt.

BOIR UPDATED FILING DEADLINES:

- Reporting Companies that were created or registered prior to January 1, 2024, have until January 13, 2025, to file their initial beneficial ownership information reports with FinCEN. (These companies would otherwise have been required to report by January 1, 2025.)

- Reporting Companies created or registered in the United States on or after September 4, 2024, that had a filing deadline between December 3, 2024, and December 23, 2024, have until January 13, 2025, to file their initial beneficial ownership information reports with FinCEN.

Corporate Transparency Act – Background

- Reporting Companies created or registered in the United States on or after December 3, 2024, and on or before December 23, 2024, have an additional 21 days from their original filing deadline to file their initial beneficial ownership information reports with FinCEN.

The CTA requires each Reporting Company to file an initial Beneficial Ownership Interest Report (“BOIR”) with the FinCEN. With the exception of a business trust (aka statutory trust), a trust is not a Reporting Company under the CTA.

The revised filing deadlines for a Reporting Company’s initial BOIR are summarized as follows:

Reporting Company Formation Filing Deadline Formed before January 1, 2024 On or before January 13, 2025 Formed on or after January 1, 2024, and prior to September 4, 2024 90 days after the entity is formed Formed between September 4, 2024, and September 24, 2024 On or before January 13, 2025 Formed on or after September 25, 2024, and prior to January 1, 2025 90 days after the entity is formed Formed on or after January 1, 2025 30 days after the entity is formed

Additionally, if there is any change to the required information about the Reporting Company or its beneficial owners in a filed BOIR, the Reporting Company must file an updated BOIR within 30 days after the date on which the change occurred. The willful failure to file a complete (or accurate) BOIR or updated BOIR may result in civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues or criminal penalties, including imprisonment for up to two years and/or a fine of up to $10,000. The senior officers of a Reporting Company may be held accountable for any BOIR filing failure.

A BOIR contains information about the Report Entity and two categories of individuals: Beneficial Owners and Company Applicants. A Beneficial Owner is any individual who, directly or indirectly, (1) exercises “substantial control” over a Reporting Company or (2) owns or controls at least 25% of the ownership interests of a Reporting Company. An individual exercises substantial control over a Report Entity if the individual meets any of four general criteria: (1) the individual is a senior officer of the Reporting Company; (2) the individual has the authority to appoint or remove certain officers or a majority of directors of the Reporting Company (3) the individual is an important decision-maker for of the Reporting Company; or (4) the individual has any other form of substantial control over the Reporting Company. Please note that substantial control and/or indirect ownership may require a legal analysis. Indirect ownership occurs when another entity, such trust, corporation, or LLC, holds ownership interests in a Reporting Company.

A Company Applicant is any individual who (1) directly files the document creating the Reporting Company or (2) was primarily responsible for directing or controlling the filing of the document creating the Reporting Company. Company Applicant information is only required to be reported for Reporting Entities created after December 31, 2023.

CURRENT RECOMMENDATIONS

- Be prepared to file or have filed BOIRs for each of your Reporting Companies shortly after January 1, 2025.

The process of obtaining your FinCEN ID requires two-factor verification (your email address and either a text message to your cell phone or authentication through an authentication app). Therefore, this is a task that you will need to undertake. The process requires that you sign in or create an account with LOGIN.GOV. After you are logged in to LOGIN.GOV account, you’ll be able to apply for and obtain your FinCEN ID simply by providing your name, date of birth, address, unique identifying number and issuing jurisdiction from an acceptable identification document (driver’s license or passport), and an image of the identification document (please have a PDF or JPEG copy of your identification document available to upload to FinCEN when applying for your FinCEN ID).

- Obtain an individual FinCEN Identifier (“FinCEN ID”), especially if you have multiple Report Companies, if you have not already done so. A FinCEN ID is a number assigned by FinCEN for BOIR filings. Using your FinCEN ID will enable a filer to file a Reporting Company’s BOIR quickly by utilizing that number rather than disclosing personal information, including a copy of your driver’s license or passport, on each BOIR. Obtaining your FinCEN ID will not only make filing initial BOIRs much more efficient; it will eliminate the need to file updated BOIRs for all of the Reporting Companies that you are considered Beneficial Owner if you obtain a new driver’s license (other identifying document) that includes a changed name, address or identifying number.

This link FinCEN ID | Financial Crimes Enforcement Network (FinCEN) can be used to obtain your FinCEN ID.

KC Masterpiece

Hard Core 4+

- Joined

- May 4, 2019

- Messages

- 1,923

They stayed it again since then. I think it was a few days ago.man, I was hoping to blow this off... but it looks like it's legit again. Here's the most recent info I received from my CPA, received on thursday:

Ah didn't realize that... thanks. Well I will see my CPA on NYE, will ask him then what the deal is...They stayed it again since then. I think it was a few days ago.

Other than the added tasks here, is there a downside to just filing the thing? what is it, $15?

Last edited:

RDub

Trail Ready

I don’t remember a fee of any kind when we filed. But my memory can be sieve-like.

HDavis

Hard Core 4+

- Joined

- Feb 13, 2019

- Messages

- 1,381

I am pretty sure it was free. I dont recall paying anything.I don’t remember a fee of any kind when we filed. But my memory can be sieve-like.

KC Masterpiece

Hard Core 4+

- Joined

- May 4, 2019

- Messages

- 1,923

No fee to file. It's just to get them more info.

them, as in our government? So we're basically taking data that's already on file with the Secretary of State, adding in driver's license info already on file with the DMV, then uploading it to the US treasury department. And the fact that I find this concatenation effort on their behalf somewhat trivial just means I'm probably not the shell company, money laundering bad guy they're after here, right?No fee to file. It's just to get them more info.

I launder all my money in a front loading Whirlpool. Making sure to use it on colors without bleach. Makes all my money look real nice.

Yeah, I just got the same news from the CPA...

Dear Valued Client,

We are writing to provide another important update regarding the Beneficial Ownership Information (BOI) reporting requirements under the Corporate Transparency Act (CTA).

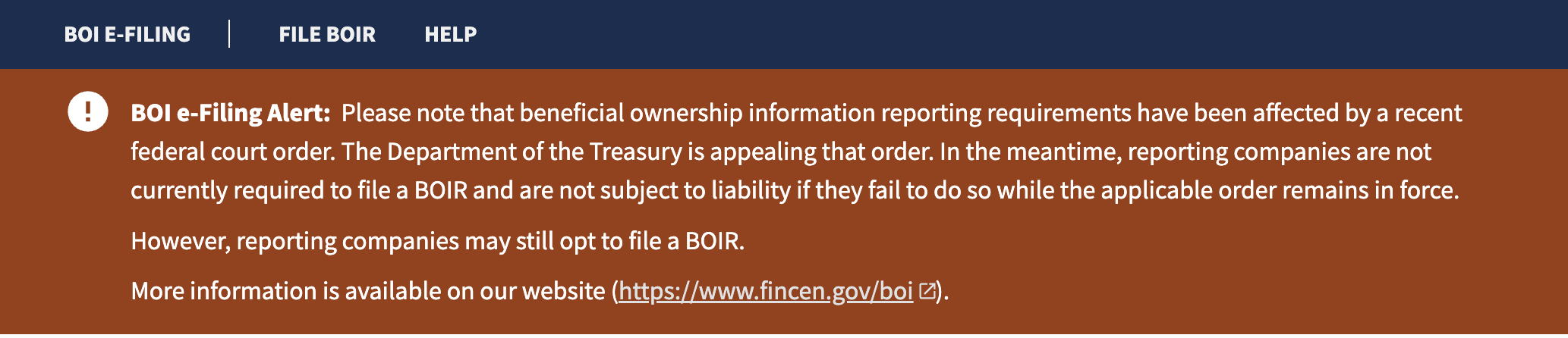

The situation regarding these requirements has been rapidly evolving. As of December 26, 2024, the nationwide injunction issued on December 3, 2024, has been reinstated, meaning that BOI reports are not currently required to be filed.

We recognize that the back-and-forth on this issue has been confusing and frustrating. While no action is required at this time, we encourage you to remain prepared should the requirements be reinstated in the future.

We will continue to monitor this matter closely and keep you informed of any changes. If you have any questions, please feel free to reach out to us.

Thank you for your patience and trust as we navigate this together. Happy New Year!

nuclearlemon

Hard Core 4+

cause you know the guy laundering money is going to rush out and file this crapI'm probably not the shell company, money laundering bad guy they're after here, right?

J1000

Rising Sun Member

Looks like the injunction has been stayed at least through March 25, when oral arguments are supposed to take place. Personally, I am putting this off until the last second.

www.performanceracing.com

"A late-breaking legal development has put on hold the deadline for small businesses to file a report with the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) on their beneficial ownership information (BOI). BOI reports are a requirement under the Corporate Transparency Act (CTA), a 2021 federal law that is intended to enhance transparency in entity structures and ownership to combat money laundering, tax fraud and other illicit activities. Previously, reports were required to be filed with FinCEN by January 13, 2025. However, the Fifth Circuit Court of Appeals put this filing deadline on hold with its December 27 decision.

www.performanceracing.com

"A late-breaking legal development has put on hold the deadline for small businesses to file a report with the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) on their beneficial ownership information (BOI). BOI reports are a requirement under the Corporate Transparency Act (CTA), a 2021 federal law that is intended to enhance transparency in entity structures and ownership to combat money laundering, tax fraud and other illicit activities. Previously, reports were required to be filed with FinCEN by January 13, 2025. However, the Fifth Circuit Court of Appeals put this filing deadline on hold with its December 27 decision.

The next step is for the court to hear arguments on March 25, 2025, when it will decide on whether to keep the injunction in place (i.e., the delay in implementing the BOI rule) while the broader case is heard by the full court. Accordingly, the delay in companies having to file BOI reports with FinCEN is expected to stay in place through the end of March 2025. The only thing that could speed up this timeline is if the federal government appeals the Fifth Circuit's injunction to the Supreme Court of the United States (SCOTUS) and the SCOTUS intervenes in favor of reinstating implementation of the rulemaking.

While the recent delay in implementation of the BOI filing deadline is positive news for small businesses, the lack of consistency from the courts underscores the need for a longer delay in implementing the rule. Moving forward, SEMA and other associations that represent small businesses are seeking to have the Trump Administration delay implementation of the BOI rule through December 31, 2025."

Federal Courts Puts Beneficial Ownership Report Filing Deadline on Hold

The next step is for the court to hear arguments on March 25, 2025, when it will decide on whether to keep the injunction in place (i.e., the delay in implementing the BOI rule) while the broader case is heard by the full court. Accordingly, the delay in companies having to file BOI reports with FinCEN is expected to stay in place through the end of March 2025. The only thing that could speed up this timeline is if the federal government appeals the Fifth Circuit's injunction to the Supreme Court of the United States (SCOTUS) and the SCOTUS intervenes in favor of reinstating implementation of the rulemaking.

While the recent delay in implementation of the BOI filing deadline is positive news for small businesses, the lack of consistency from the courts underscores the need for a longer delay in implementing the rule. Moving forward, SEMA and other associations that represent small businesses are seeking to have the Trump Administration delay implementation of the BOI rule through December 31, 2025."

J1000

Rising Sun Member

I guess it's dead.

Inukshuk

Rising Sun Member

I'm ok with this.I guess it's dead.

Definitely dead. I got this in my email today for an Idaho client of mine:

Dear Idaho Business Owner,

We are pleased to inform you of a significant update regarding the Corporate Transparency Act (CTA) requirements for businesses in Idaho and across the United States.

On March 21, 2025, the U.S. Department of the Treasury issued an interim final rule eliminating the Beneficial Ownership Information (BOI) reporting requirement under the CTA for business entities created in the United States. This decision follows sustained efforts by Secretary of State Phil McGrane and other leaders to highlight the unnecessary burden these requirements placed on small businesses. After hearing these concerns, the federal government has finally acted to relieve small businesses of this reporting obligation. Thanks to these efforts, Idaho businesses are no longer required to submit BOI reports.

For more information regarding Beneficial Ownership Information reporting visit FinCEN: https://www.fincen.gov/boi

You may also submit comments or questions by contacting FinCEN.

Our office is hopeful that this will be our final update regarding the Corporate Transparency Act (CTA). We appreciate your patience during this process.

Sincerely,

Idaho Secretary of State's Business Services Division

Dear Idaho Business Owner,

We are pleased to inform you of a significant update regarding the Corporate Transparency Act (CTA) requirements for businesses in Idaho and across the United States.

On March 21, 2025, the U.S. Department of the Treasury issued an interim final rule eliminating the Beneficial Ownership Information (BOI) reporting requirement under the CTA for business entities created in the United States. This decision follows sustained efforts by Secretary of State Phil McGrane and other leaders to highlight the unnecessary burden these requirements placed on small businesses. After hearing these concerns, the federal government has finally acted to relieve small businesses of this reporting obligation. Thanks to these efforts, Idaho businesses are no longer required to submit BOI reports.

For more information regarding Beneficial Ownership Information reporting visit FinCEN: https://www.fincen.gov/boi

You may also submit comments or questions by contacting FinCEN.

Our office is hopeful that this will be our final update regarding the Corporate Transparency Act (CTA). We appreciate your patience during this process.

Sincerely,

Idaho Secretary of State's Business Services Division